Gum arabic from Africa’s acacia trees in the Sahel is used in hundreds of products: what’s worth knowing

Asgar Ali, University of Nottingham

The conflict in Sudan has turned attention to a rarely discussed commodity: gum arabic. This product, the dried sap of certain species of acacia trees, is used mainly as an additive in the soft drinks industry. Sudan accounts for about 70% of global gum arabic exports. Asgar Ali, an expert in sustainable food systems, answers questions about the commodity and its prospects.

What is gum arabic?

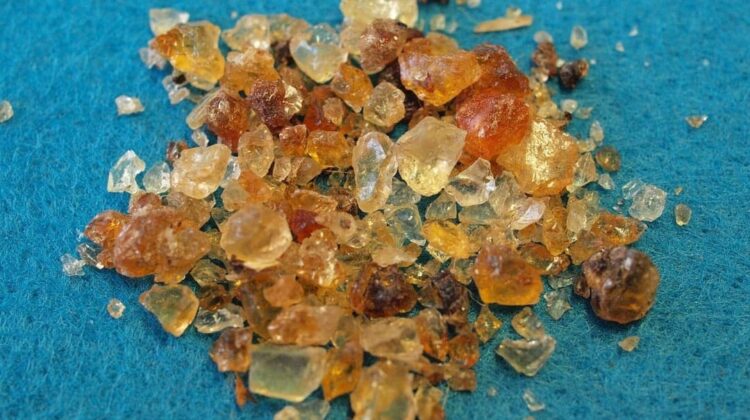

Acacia gum, commonly called gum arabic, is derived from certain kinds of acacia trees: Senegalia senegal and Vachellia seyal.

Sap is extracted from acacia trees by cutting incisions in their bark that allow the liquid to seep out. After that, the sap turns into gum.

Its distinct qualities and water solubility make it useful across a range of sectors, including pharmaceuticals, food and beverages, and personal care industries. It is an ingredient in processed meals, soft drinks and confections, a thickening agent in chewing gums, a binder in watercolour paints, as additive in ceramic glazes and an adhesive in the rolling papers used in cigarettes. It is a well-known emulsifier, an additive which helps two liquids mix. It’s also used in textiles and medicines.

Gum arabic has been around for ages. Its first recorded use dates back to 2000 BC, when ancient Egyptians employed it in foodstuffs, hieroglyphic paints and mummification ointments.

Where is it produced?

Gum arabic is produced mainly in the Sahel area of Africa, the region stretching from Senegal on the Atlantic coast, through parts of Mauritania, Mali, Burkina Faso, Niger, Nigeria, Chad and Sudan to Eritrea on the Red Sea coast. In east Africa, it is produced in Kenya, Somalia and Tanzania.

Sudan is a significant producer as well as a key player in the processing and export of premium gum arabic to markets across the world. Another well-known producer, Chad, has also advanced its ability to extract gum arabic.

The Sahel is dry and semi-arid, ideal for acacia plants.

In addition, the Sahel’s climate is perfect for the harvesting of the sap. During the sap harvesting season, high temperatures, low humidity and little rainfall encourage the sap to dry and harden quickly once it’s seeped out from cuts in the tree bark. It is then harvested.

There is an extensive value chain (a range of activities from farming to processing and marketing) for gum arabic in Africa, especially in Sudan and Chad. These countries have vast acacia forests and plantations and gum processing facilities.

Gum arabic is a major agricultural product in Sudan after oily seeds. Nearly half of Sudan’s production (49.3%) is from the Kordofan region. The Kassala (24.4%), Darfur (23.4%) and White and Blue Nile (2.9%) regions account for the other half. In 2019, Sudan exported the gum mainly to the European Union (51,060,900kg), India (13,414,300kg) and the UK (3,299,710kg).

The market is quite liberalised in Sudan, where private entities clean, sort, grade and pack the gum at processing facilities. Until 2009, a monopoly existed in Sudan: the Gum Arabic Company, partly state-owned, was the only entity allowed to export the commodity.

What are its uses?

In the Sahel, gum arabic has been used for centuries to stabilise and thicken food. It’s also used medicinally to soothe sore throats and help with digestive problems.

Since the industrial revolution, the gum has been used on an industrial scale:

- In the food and beverages sector, gum arabic serves as an emulsifier and stabiliser. It is frequently used to improve texture and mouthfeel, and to avoid crystallisation in processed foods, soft drinks and confectionery.

- In pharmaceuticals, it is used to encapsulate pills, make solutions and bind tablets.

- In textiles it is used to fix colours in printing and dyeing.

- In photography and painting it is used as a coating for light-sensitive items and as a binder for paints.

What are its prospects?

Gum arabic has bright future possibilities for a number of reasons.

It is ideally positioned to satisfy the growing demand in the food sector for natural ingredients.

Its dietary fibre content means that new uses could be found for it as a nutritional supplement.

Gum arabic may find new uses in a variety of sectors as a result of ongoing research and innovation, expanding its market.

What are the threats?

Political instability could have a significant impact on the gum arabic market, particularly in Sudan.

Sudan has been a key player in the gum arabic industry for decades. But it has faced political instability, civil conflicts and economic challenges. Exports from Darfur and Kordofan have been severely affected since the start of the war with suppliers warning their stockpiles could run out soon if the fighting continues. A drop in production would mean reduced or less reliable exports, affecting the global supply chain.

International buyers often seek stable sources of raw materials to ensure a consistent supply, and political instability in Sudan could make this difficult.

Somalia is not as large a producer as Sudan. But the country’s prolonged political instability and conflicts have disrupted its agricultural and export sectors, including gum arabic production. This reduces the overall market size and limits Somalia’s ability to participate in the international gum arabic trade.

Sustainable cultivation of acacia trees and good gum harvesting practices will be essential to secure a reliable and long-term supply of gum arabic, contributing to its prospects.

Asgar Ali, Professor of Post-harvest Biotechnology & Nutrition and Director, Centre of Excellence for Post-harvest Biotechnology (CEPB), University of Nottingham

This article is republished from The Conversation under a Creative Commons license. Read the original article.